Every nonprofit organization needs to have an effective governing structure in place. This structure is typically fulfilled through a nonprofit board of directors, which is a governing body that oversees and influences many different aspects of the organization.

There are a wide variety of activities in which nonprofit boards might take interest. Typically, the topics a board discusses and decides upon are high-level issues of mission, strategy, and accountability, not day-to-day management issues. Except at very small nonprofit organizations, the people who serve on the management team are usually not the same people who serve on the board of directors. Management is typically paid staff, whereas board members are generally volunteers.

Board of Directors Key Roles

Boards of directors are made up of a few different key roles, including:

A chairperson. This member serves as the leader of the board and presides over meetings. This individual is also often called the board president.

A vice-chair. Also known as a chair-elect, or vice president, this member supports the board chairperson. The vice-chair is often expected to step up into the role of chairperson at some point in the future.

A secretary. This role entails managing many of the logistical aspects of running a board of directors effectively, including notifying board members of meetings, distributing meeting agendas, and taking meeting notes.

A treasurer. Treasurers oversee the organization’s finances and makes financial decisions for the organization. Board treasurers need to be very trustworthy individuals, and it helps considerably if they have a financial background already.

Nonprofit boards meet as often as necessary to fulfill the needs of the organization. The most effective nonprofit boards are often composed of individuals who can contribute a diverse range of perspectives to the decision-making process. Board members are also responsible for championing the organization’s identity and helping to shape that identity.

A few specific nonprofit board of directors responsibilities include (among many others):

- Developing a mission statement that outlines clear goals and a cohesive vision for the organization.

- Making high-level strategic decisions for the organization and ensuring those decisions remain aligned with the organization’s identity and mission statement.

- Reviewing and approving the organization’s budgets and expenses.

- Ensuring the organization’s compliance with applicable legal regulations.

Nonprofit Board Of Directors Roles And Responsibilities

Let’s examine some of the board responsibilities nonprofit board members are expected to uphold in more detail.

The responsibilities of each board member varies somewhat according to their level of experience. For example, a new board member would not have the same responsibilities as the board chairperson. Each individual’s board responsibilities also depend upon their specific role on the board; some board roles, like the board treasurer, have particular duties that no other board member shares. However, even though the specific roles of nonprofit boards play a significant part in determining each board member’s responsibilities, every board member, no matter what role they serve in, is generally expected to carry out a few basic duties:

1. Duty of care

Duty of care is a board member’s responsibility to do everything they are able to help further the organization’s mission. This means committing themselves to the good of the organization and upholding promises and obligations to the organization. For example, board members need to maintain consistent board meeting attendance and fully engage themselves with whatever committees they serve on or whatever duties they’re given. They’re also responsible for maintaining clear and effective communication with other board members and the nonprofit executive director. Every board member needs to be motivated and committed to the organization’s purpose for board strategy to be effective.

2. Duty of loyalty

Duty of loyalty is each board member’s responsibility to put the organization’s best interests ahead of their own personal and professional interests when acting on behalf of the board. Just showing up to board meetings isn’t enough. Board members should be active champions of the organization’s values, identity, and mission. The more engaged board members are with their organization’s communities, facilities, and initiatives, the better the board will function.

3. Duty of obedience

Duty of obedience is board members’ responsibility to operate within the organization’s guidelines. While dedicated board members should do everything they can to help the organization further its mission, each organization needs to remain on the right side of legal regulations and other governance rules. Board leaders have a responsibility to provide every board member with a copy of the rules and regulations the organization must operate within, and every board member has a responsibility to understand and respect those rules and regulations.

Nonprofit Board Of Directors Structure

A nonprofit board of directors is typically structured around a few important positions. Any effective governance committee needs to be well-organized — by adhering to an established nonprofit board of directors structure, boards can remain organized and function efficiently.

These are the nonprofit board of directors positions that make up the core leadership of the board:

1. Chairperson

The board chairperson is the elected leader of the board of directors. Sometimes, the chairperson is called the president. The chairperson presides over meetings and carries out other duties, including:

- Working with the CEO or executive director to create agendas for board meetings

- Deciding which board members will sit on which board committees and appointing committee chairs

- Acting as the main point of contact for board-related matters

- Holding members accountable for meeting the nonprofit board’s goals

2. Vice-chair

If the chairperson is the board’s leader, the vice-chair is the second-in-command. The vice chair is also called the chair-elect or the vice president, and is expected to support the chairperson and other board leadership however needed. Other responsibilities include:

- Preparing to take over the office of chairperson when needed in the future

- Stepping in as temporary chairperson if the chairperson is unable to fulfill their duties

- Serving on board committees as assigned

3. Secretary

The secretary holds some of the most important of the board of directors’ responsibilities. Board secretaries are in charge of ensuring board matters operate smoothly and efficiently. For example, some of a secretary’s most significant duties include:

- Scheduling and notifying board members of upcoming board meetings

- Verifying that the board chairperson has prepared an agenda and distributing the agenda to board members in advance

- Gathering and distributing other necessary background materials or resources prior to board meetings

- Recording official board meeting minutes

4. Treasurer

The final of the four main nonprofit board of directors positions is the board treasurer. The treasurer is responsible for financial decisions, including investing and spending, and for generally overseeing the organization’s financial concerns. Specific duties include:

- Filing relevant tax documents and other legal forms

- Reconciling bank accounts and presenting financial statements at board meetings

- Serving on the board finance committee as chair and assisting with the finance committee’s responsibilities.

- Collaborating with the CEO or CFO to prepare annual budgets and presenting them for board approval.

Each of these roles is responsible for a few duties in particular, but there are also general obligations like the duties of care, loyalty, and obedience that are the responsibility of every member of the board of directors. Nonprofit responsibilities are shared by all; leadership positions simply have some additional expectations placed on them.

Nonprofit Board Governance vs Board Management

Board governance and board management may sound very similar, but these two terms are not interchangeable. Nonprofit management refers to paid staff or volunteers to handle the day-to-day operations of the organization. Nonprofit governance is the high-level strategizing and oversight carried out by the board of directors. It’s very important to understand the difference between board governance and board management.

In general, board management deals with daily operational decision-making, whereas board governance is concerned with steering the organization more broadly. In other words, governance is about establishing rules and guidelines to keep the organization on course toward achieving its mission; management is about putting those rules and guidelines into action throughout every level of the organization so their desired effects are actually achieved.

Today, many modern boards of directors at nonprofit organizations function as digital boards. This means they leverage digital board governance technology to remain organized and effective. In the next section, let’s explore this type of technology in a little more detail.

Today, many modern boards of directors at nonprofit organizations function as digital boards. This means they leverage digital board governance technology to remain organized and effective. In the next section, let’s explore this type of technology in a little more detail.

Modern Board Governance and Board Structure

A nonprofit board of directors is made up of a few key roles, each with their own unique responsibilities. These roles, including chairperson, vice-chair, secretary, and treasurer comprise the board’s leadership, but each and every board member is expected to uphold certain responsibilities of their own, including the duties of care, loyalty and obedience.

Nonprofit boards rely on a carefully organized board structure to ensure effective modern governance. A major component of this structure is the established board roles and their various responsibilities.

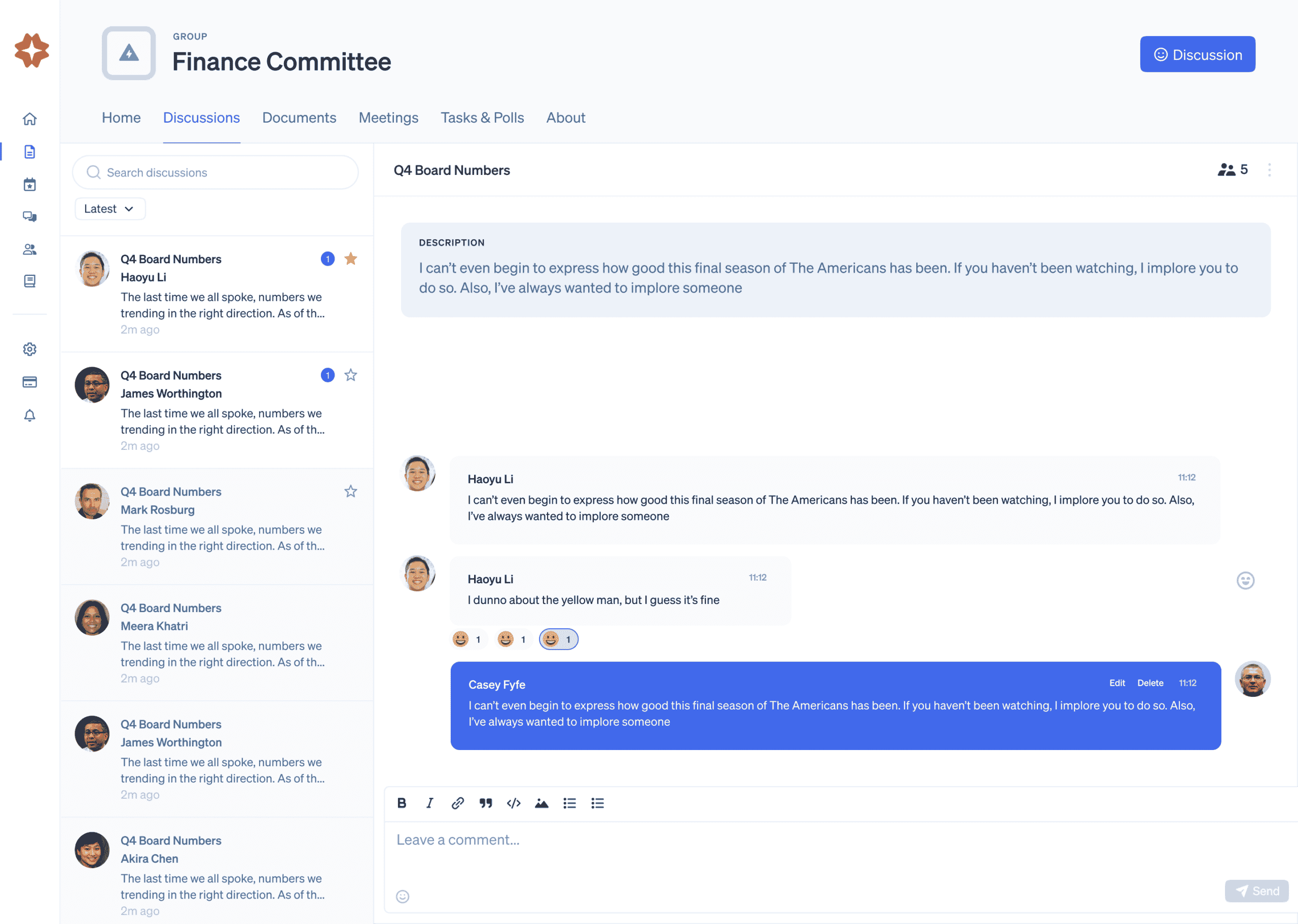

Some nonprofit organizations use dedicated tools for improving board management. Digital board management software like Boardable can help nonprofit board members get organized and stay active. The Boardable platform is designed to streamline board communication and unlock new levels of productivity, all while remaining scalable and user-friendly. Nonprofit boards that are struggling to remain efficient and organized may be able to use Boardable to achieve better nonprofit governance.

Ready to drive greater outcomes with powerful board software? See how Boardable can support your board’s fundraising efforts. Start free now.